In Colorado, Are Property Taxes Included In Your Mortgage Payment?

Property taxes can be a confusing and daunting expense for homeowners in Colorado. Whether you’re buying your first home or refinancing an existing mortgage, understanding how property taxes are handled is essential to ensure you’re making the best financial decisions. In this article, we will discuss the basics of property taxes and answer the question – are they included in mortgage payments? We’ll explain payment options, benefits, risks, and what to look for when reviewing your mortgage agreement. With this information, you can decide what works best for your finances.

What are Property Taxes?

Wondering what property taxes are? Let’s take a closer look! Property taxes are a type of tax levied on real estate, typically based on the property’s value. This means that if you own a house in Colorado or any other state, you will likely be responsible for paying property taxes each year. While these taxes seem like an added expense to homeowners, they often go towards funding important local services such as schools and public safety initiatives. Property taxes also help to ensure that communities have access to necessary resources and amenities.

Typically, property owners receive their tax bills from the county or municipality where they live in order to pay their annual taxes. When it comes to mortgages in Colorado, it is important to note that these payments are not always included in your mortgage payment. Depending on your lender’s policies and procedures, you could be required to make separate payments for your mortgage and your property taxes each month or year. It is best to consult with your lender before signing any documents to understand exactly how much money will be due each month for both types of payments.

Keep in mind that even if your mortgage does not include property taxes as part of its monthly payment amount, you may still qualify for certain deductions and credits when filing your yearly tax returns. Be sure to research all available options before filing to maximize any potential savings related to these two types of payments – the cost of owning real estate can add up quickly without taking advantage of every possible opportunity for savings.

How Are Property Taxes Calculated?

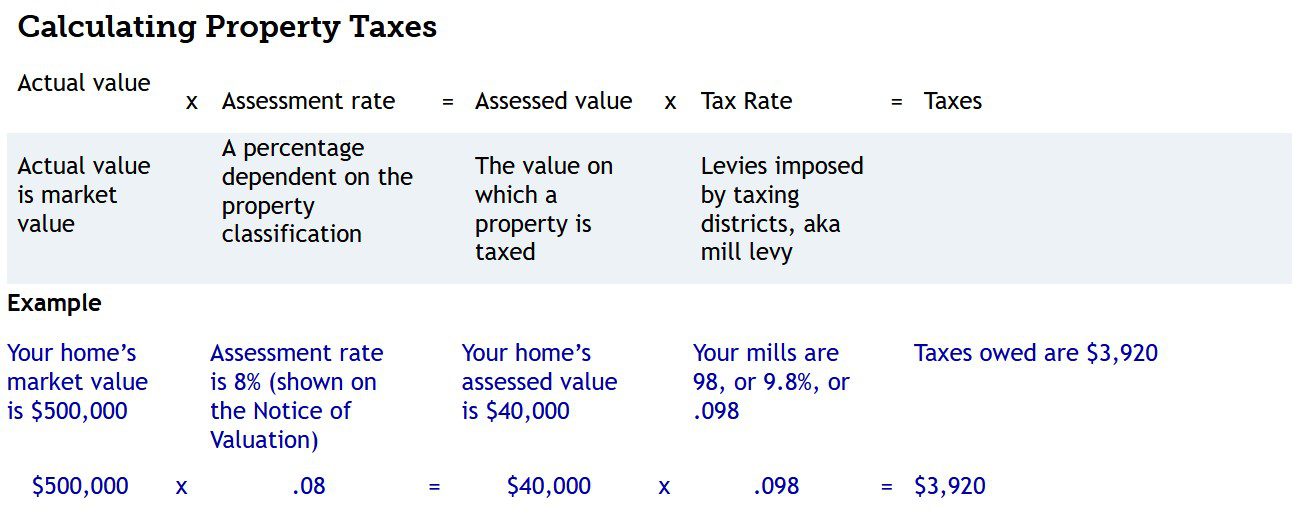

Figuring out how much you’ll owe in taxes on your new home can take time and effort. Let’s explore the process. Property taxes are calculated based on a property’s assessed value, which is usually less than its market value. Your local government assesses property values by looking at recent sales prices of comparable homes in your area and other factors such as size, age, location, and condition. The assessed value is then multiplied by the tax rate to determine your total annual tax liability.

Your local government sets the tax rate each year, taking into consideration the cost of providing services like schools and public safety in your community. The rate can vary significantly from one locality to another, so it’s important to research what you may expect before making any commitment to purchase a particular house or piece of land. You’ll also want to check with your lender about whether any additional fees related to property taxes will be included in your mortgage payment or if they will need to be paid separately when due.

Since property taxes are typically paid annually or semi-annually, knowing how much you’ll owe each time can help you plan ahead financially for paying them when they come due. If possible, try to build up some savings that you can use for this purpose since most lenders won’t allow these payments to be included in your mortgage loan principal balance or interest rate calculations. Doing so can help ensure that you don’t fall behind on paying them when they’re due and avoid potential penalties or other issues down the road.

Are Property Taxes Included in Mortgages?

Knowing if your property taxes are part of the equation can take a load off your shoulders, so find out before signing on the dotted line. In Colorado, some mortgages may include property taxes in their monthly payments; however, it is not required. When purchasing a house in Colorado with a mortgage loan, you should confirm whether or not the lender will be covering the property taxes:

It’s important to be aware of all possible expenses when deciding on a mortgage and budgeting for your new home purchase. Make sure to review all documents carefully and ask questions about anything that might affect what you can afford—including potential changes or increases to property tax rates—before making any commitments. Doing so could help ensure that buying a house won’t put too much strain on your finances now or in the future.

Payment Options

In Colorado, there are three main ways to pay for property taxes: a lump sum payment, an installment plan, or a mortgage escrow account. Paying your taxes in full is usually the easiest way to get them out of the way quickly and avoid late fees. However, if you don’t have enough cash on hand, it may not be feasible.

You can also opt for an installment plan if you prefer to spread out payments over several months rather than paying all at once. This option allows you to keep more money in your pocket each month by only paying set amounts towards your tax bill until it’s paid off completely. Just keep in mind that interest charges may apply depending on how long it takes you to pay off the balance.

Finally, when taking out a mortgage loan in Colorado, homeowners often choose to include their property taxes with their monthly mortgage payments by creating an escrow account with their lender or servicer. This approach eliminates any worry about forgetting or missing payments since everything is handled automatically and paid directly from your bank account each month. The downside is that lenders typically charge an additional fee for this service and require borrowers to put up extra funds upfront as part of the escrow deposit requirement.

By including your property taxes in a mortgage, you can save yourself the hassle of remembering and submitting monthly payments – allowing you to take a breath of relief like a cool summer breeze. Incorporating your property taxes into your mortgage payments provides for one payment each month that will cover both principal and interest on the loan and any applicable local or state taxes due. This also eliminates the worry of missing tax deadlines or being responsible for large lump sum payments during certain times of the year.

In addition to this convenience, by bundling all these costs together, you may also end up paying less than if you were making separate payments. Depending on where you live, rates such as points, origination fees, and other closing costs may be offset by adding property taxes and insurance premiums to your mortgage amount. This is especially beneficial when interest rates are at their lowest since more potential savings are available from rolling all these expenses into one single loan payment.

Moreover, including property taxes in your mortgage payment can make it easier to budget each month since all of the related costs are consolidated into one fixed loan payment amount rather than several different bills due at various times throughout the year. This makes it easier to anticipate what needs to be paid and when so that an unexpected expense does not blindside you down the road. Additionally, combining these expenses could potentially help homeowners qualify for larger loans than they would otherwise have access to – helping them purchase better homes that meet their needs without going over budget on monthly payments.

Understanding the risks associated with combining your housing costs and taxes into a single loan payment can help you decide what’s best for you. One of the main drawbacks to including property taxes in your mortgage payment is that it could lead to negative equity if home prices decrease significantly. Negative equity occurs when the amount owed on a property exceeds its actual value, and it can be difficult or impossible to sell the home until that debt is paid off. In addition, having your taxes included in a mortgage may cause you to lose out on certain tax deductions and credits that are available only for those who pay their taxes separately.

Another potential risk of combining your mortgage payment and taxes is being charged too much in interest each month by the lender due to a mistake or misunderstanding between you and them. The lender will typically charge interest based on the total cost of both payments, so it’s important to ensure they accurately determine this number before signing any documents. Additionally, some lenders may require larger down payments if you decide to include your property tax bill in your mortgage payments due to the increased risk involved with providing such loans.

If you choose this option, it’s important that you stay up-to-date on all changes related to local tax laws and changes related to the current rate of inflation or deflation so they do not exceed what would be considered reasonable limits by law. It’s also important that you understand how these factors could affect how much money is taken from each monthly payment towards property taxes so that there isn’t a surprise when tax time arrives each year.

Knowing the ins and outs of your mortgage agreement can be a real minefield, so it pays to have all your ducks in a row. Here are some things to consider when it comes to understanding your mortgage agreement:

Pros

- Having an understanding of the details of your mortgage contract is important in order to protect yourself financially moving forward.

- Knowing what’s included in your monthly payments allows you to plan ahead and budget accordingly.

Cons

- Not being familiar with the terms of the agreement could mean you miss out on potential savings or tax breaks.

- Not paying attention to detail could land you in legal trouble if any dispute arises over payments or other related issues.

It’s not just enough to know what’s included in your mortgage payment but also to have a full understanding of how those payments will be allocated and distributed.

You’ve learned a lot about property taxes and how they relate to mortgages in Colorado. Including property taxes in a mortgage can be beneficial if you’re looking for simplicity in your finances, but it’s important to consider the risks as well. Make sure you fully understand your mortgage agreement before making this decision, and consider all the factors that affect your unique situation. Ultimately, it comes down to personal preference and what works best for you. By weighing the pros and cons carefully, you can make an informed decision that is right for you.