What is the Colorado Emergency Mortgage Assistance Program (Colorado Homeowner Assistance Fund)?

Are you a Colorado homeowner in need of assistance? The Colorado Homeowner Assistance Fund can provide the help you need. This fund provides financial relief to eligible homeowners who are facing challenges with their mortgage payments due to hardships related to COVID-19 or other issues. In this article, we’ll explore what the Colorado Homeowner Assistance Fund is and how it can benefit you as a homeowner.

If you have difficulty making your monthly mortgage payment, then the Colorado Homeowner Assistance Fund may be able to give you some extra support. This program offers up to $20,000 in funds for qualified recipients, allowing them to get back on track financially and remain in their homes. With assistance from this program, many Coloradans have been able to keep their homes despite unexpected economic hardship.

The good news is that anyone who meets certain eligibility requirements can apply for these funds and start getting the help they need right away! We’ll discuss more who’s eligible for this fund and how it works throughout the rest of this article. So if you’re looking for an opportunity to make ends meet while staying in your home during difficult times, read on — the Colorado Homeowner Assistance Fund could be just what you’ve been searching for!

Details of the Colorado Homeowner Assistance Fund program

The Colorado Homeowner Assistance Fund (CHAF) was established to provide relief for homeowners who are struggling with their mortgage payments. It provides up to $25,000 in assistance per eligible homeowner and can be used for a range of purposes, including mortgage payments, home repairs, or other costs associated with the foreclosure process. This fund helps keep Coloradans in their homes by making it easier to stay current on their mortgages and mitigating any long-term effects of financial hardship.

CHAF is available to all homeowners across the State of Colorado who meet certain criteria. The program has been designed to target those most at risk: low –and moderate-income households whose finances have been impacted by job loss, reduced work hours, serious illness, death of a spouse, or disability. Eligibility requirements must be met before an application can be approved.

Eligibility Requirements

Like a beacon of hope, the Colorado Homeowner Assistance Fund offers a light in these difficult times. To be eligible to receive assistance through this program, applicants must meet certain requirements.

Applicants must own and occupy their primary residence located within the State of Colorado. The residence must have been purchased at least one year prior to applying for help from the fund. All mortgages that are subject to foreclosure must be delinquent by 90 days or more on payments due as dated on the promissory note. Additionally, applicants may have yet to receive any other type of state mortgage-related assistance within the last two years.

The program also requires an applicant’s total household income to fall below 80% of the area median income (AMI) level established by HUD guidelines for the county where they reside. Furthermore, all loans receiving funds can only include those owned or serviced by approved lenders and investors who agree to participate in this program. With such stringent rules in place, potential recipients need to understand exactly how this process works and what steps need to be taken next in order to apply for funding and save their home from foreclosure.

How To Apply

The Colorado Homeowner Assistance Fund (CHAF) offers assistance to eligible homeowners in the form of grants and loan repayments. In order to apply, applicants must meet certain criteria. Here’s how:

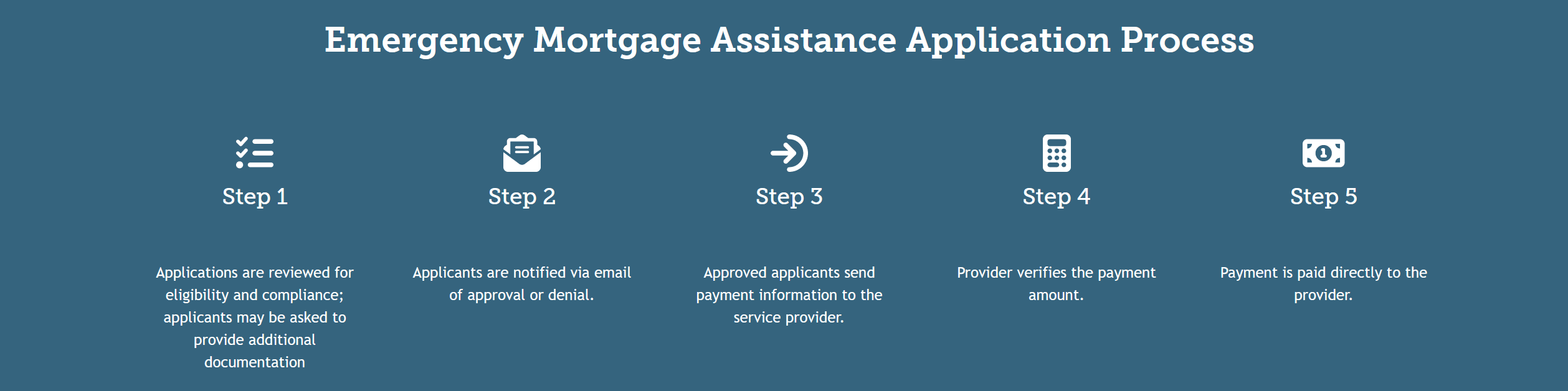

Once these requirements have been met and submitted correctly with all necessary documentation included, applicants can expect a response regarding their eligibility within 30 days of submission. The next section outlines what types of assistance may be available through CHAF if approved.

Types Of Assistance Provided

The Colorado Homeowner Assistance Fund provides help with a variety of needs. This assistance covers mortgage payments, property taxes, and other related expenses. It can also be used to assist families in meeting their home repairs or improvements needed due to health and safety issues. The fund has helped thousands of homeowners across the state by providing grants and loans for these necessary services.

In addition, the fund can provide funds for those facing foreclosure on their homes as well as help them find more affordable housing options. Furthermore, it offers counseling and additional resources so that families can make informed decisions about their financial future. All of this support helps ensure that Coloradans stay in their homes and have a successful future financially without having to worry about losing their home or going into debt. Now we’ll take a look at the maximum amounts allowed through the program.

Maximum Amounts Allowed

As the previous section touched upon, Colorado has a homeowner assistance fund to provide financial aid for those in need. This section will discuss maximum amounts allowed through this fund and other resources available for homeowners.

The maximum amount of money that can be received from the Colorado Homeowner Assistance Fund is $20,000 per household. These funds are designed to help cover costs associated with purchasing or refinancing a home, such as closing costs, down payments, and loan origination fees. The funds may also be used towards emergency repairs on existing homes. Funds cannot exceed 20 percent of the purchase price or appraised value of the property (whichever is less).

In addition to these state-funded grants, there are numerous federal programs aimed at helping first-time homebuyers acquire mortgages with favorable terms and rates. There are also local organizations that offer counseling services and education courses to assist potential buyers in making informed decisions regarding their housing situation. With all these tools combined, it’s clear that homeowners have access to an extensive support network when looking for ways to make owning a home more affordable.

Other Resources Available

There are many other resources available for Colorado homeowners who need assistance. The Colorado Housing and Finance Authority (CHFA) offers a variety of loan programs to help make owning a home more affordable, including the CHFA HomeAccess Loan Program, which provides down payment and closing cost assistance; the Mortgage Credit Certificate Program, which helps lower-income households reduce their federal taxes; and Veterans Affairs loans that provide competitive rates on mortgages.

The Division of Real Estate also has several programs designed to assist qualified buyers with obtaining financing or purchasing homes in certain areas. These include the Down Payment Assistance Grant Program, First Time Home Buyer Programs, Tax Credits, and Appraisal Fee Reimbursement Grants. Additionally, Fannie Mae’s HomeReady program allows eligible borrowers to use grants from local governments or employers towards their purchase of an owner-occupied residence. For those looking for rental housing options, the U.S. Department of Agriculture provides rental subsidies through its Section 8 voucher program.

Conclusion

This program has helped countless individuals in our state by providing them with the financial support they need when facing foreclosure and other challenges associated with homeownership. The process is straightforward, and I encourage anyone who might qualify for assistance to learn more about how it can help them stay in their homes.

Every day, we hear stories of families that were once on the brink of losing their homes but are now able to keep them, thanks to this wonderful program. Just recently, one family was saved from foreclosure after being approved for emergency funds through the CHAF – and that’s just one example of many! It truly goes to show what an invaluable resource this fund is for Coloradans across the city.

No matter where you live or your current circumstances, there may be options available through the Colorado Homeowner Assistance Program if you’re struggling to keep up with mortgage payments or make necessary repairs. We know times can be tough – but don’t give up hope! Reach out today and see what kind of help is waiting for you right here in Colorado.

If you’re a homeowner in Colorado, you need to know about the Colorado Homeowner Assistance Fund. The Storck Team is here to help! Our experienced team of realtors can provide you with all the information you need to understand if you qualify for this program and how to apply. Don’t wait – contact The Storck Team today and get the help you need with the Colorado Homeowner Assistance Fund!