Are Coloradans Still Buying Up Homes Despite Market Challenges?

Coloradans are grappling with challenges when buying homes. Due to high-interest rates and pricey markets like Denver and Weld County, they face declining homeownership rates, limited options, and affordability hurdles. The struggle is real. But there’s more to this housing saga.

Key Takeaways

- Homeownership rates in Colorado dropped significantly in 2023.

- Factors like high-interest rates and limited housing options impact homebuying decisions.

- Affordability challenges persist, especially in metro Denver.

- Investors influence the market, reducing inventory for first-time buyers.

- Predictions for 2024 suggest continued high home prices and increased multifamily permits.

Homeownership Trends in Colorado

Colorado’s homeownership rates sharply declined in 2023, plummeting from 70.2% to 62.7% according to recent census data, marking a significant shift in the state’s housing landscape. This drop was the largest among all states, painting a challenging picture for aspiring homeowners. The allure of Colorado for remote workers combined with high-interest rates and limited housing options has shifted the balance towards renting rather than owning. Metro Denver’s reputation as an overpriced market adds to the struggle, with affordability remaining a major hurdle. For example, builders in Weld County cater more to higher-income brackets, potentially alienating local income levels. This downward trend in homeownership rates not only reflects a change in preferences but also underscores the pressing need for addressing housing affordability across the state. As the housing market continues to evolve, the path to homeownership in Colorado is maneuvering through turbulent waters, demanding innovative solutions to make this dream a reality for many.

Factors Impacting Homebuying Decisions

Housing affordability in Colorado presents a formidable challenge for many prospective homeowners, with limited options for median-income families in metro Denver. Only 23.9% of homes sold in the area were affordable to these families, ranking Denver and Boulder low in national housing affordability. Pueblo emerges as the most affordable metro in Colorado, but the competition for these homes is intense. Shifting from renter to owner often occurs in the lower-priced market tier due to affordability constraints. It’s a tough market out there, with high demand and limited supply pushing prices beyond the reach of many. Aspiring homeowners face an uphill battle, maneuvering through an overpriced housing market while trying to secure a piece of the real estate pie. Colorado’s allure is undeniable, but for now, cracking into homeownership in this scenic state requires more than just a dream; it demands financial prowess and strategic planning.

Real Estate Market Insights

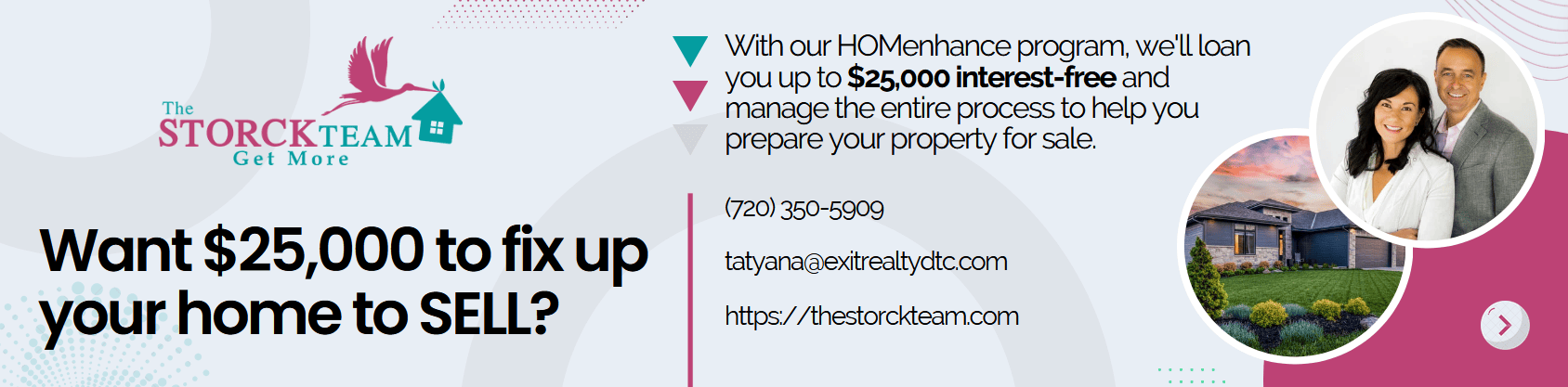

Denver’s ranking as 101st out of 148 metro areas for first-time homebuyers showcases the challenges faced by new entrants. Competition is fierce with younger demographics already owning nearly four in 10 homes. Investors are heavily targeting entry-level homes, with a purchase rate of 26.1% in that segment. Studies underscore the complexities of Colorado’s housing market, with builders adapting to market demands by focusing more on multifamily permits. This shift reflects a response to the growing need for diverse housing options. As we navigate through these insights, it’s evident that the real estate landscape in Colorado is dynamic and requires a strategic approach for both buyers and sellers. Seasoned real estate agents, like The Storck Team, can help homebuyers navigate the new norm of Colorado real estate.

Investor Influence and Future Predictions

With investors reshaping the real estate landscape in Colorado, future predictions point towards a continued surge in multifamily permits and sustained high home prices. Investors play a significant role in reducing inventory for first-time buyers and driving up prices, creating challenges for individuals looking to enter the market. Builders adapt to this shift by focusing more on multifamily units, aligning with market demands. Predictions for 2024 anticipate a critical trend of increased multifamily permits being issued, indicating the direction the market is heading. Home prices are expected to remain elevated, alongside borrowing costs, further complicating affordability issues. The influence of investors is likely to continue shaping the housing market.

Conclusion

So, are Coloradans still purchasing homes? Despite challenges like affordability and investor influence, the desire for homeownership remains strong in the Centennial State. As the real estate landscape continues to evolve, prospective buyers are maneuvering a changing market with resilience and determination. With a blend of optimism and caution, Coloradans are adapting to new trends and making informed decisions in their quest for a place to call their own.