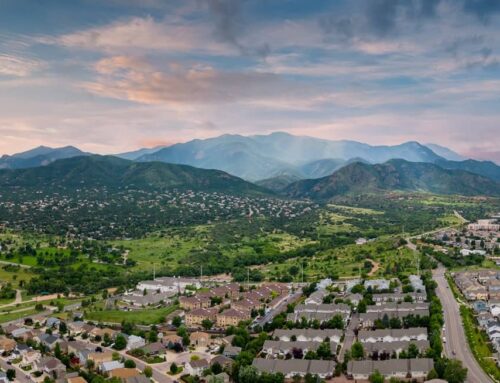

Is There a Shift Happening in Colorado Commercial Real Estate?

A discernable shift is making waves in the domain of commercial real estate (CRE). As investor preferences evolve, they are veering towards multi-family housing and industrial sectors, spurred by escalating e-commerce growth. The search for transparency and longevity has become paramount, prompting managers to adopt adaptive strategies and a spotlight on sustainable investments. Despite looming risks like inflation and climate change, the allure of high yields and diversification in budding sectors remains undiminished. This new landscape is worth deep exploration.

Key Takeaways

- Due to demographic shifts and expensive mortgages, there is a high demand for multi-family housing.

- Institutional investors prioritize managers who demonstrate resilience and long-term stability in their strategies.

- Managers are focusing on sustainable investments and robust reporting systems for increased transparency and accountability.

- Emerging sectors like multi-family housing, senior living, and data centers are offering new investment opportunities.

- Rising risks from inflation, interest rates, and climate change are challenging the commercial real estate market.

Current Commercial Real Estate Landscape

Despite the significant losses experienced in the commercial real estate (CRE) sector over recent years, analysts suggest that the worst may be behind, offering potential entry points for disciplined investors. As signs of market recovery become more apparent, certain sectors are paving the way. Particularly, multi-family housing, driven by a high housing demand, presents promising opportunities. This demand, fueled by demographic shifts and cost-prohibitive mortgages, is expected to stimulate a robust rental market. Simultaneously, the industrial sector shows signs of revival, backed by a surge in e-commerce. However, investors are urged to exercise caution and diligence, considering the dynamic nature of the CRE market. Despite the hurdles, the potential for significant returns exists for those willing to navigate the landscape strategically.

The Changing Dynamics of Investor Behavior and Manager Relationships

Institutional investors are beginning to reassess their relationships with managers in response to the shifting landscape of the commercial real estate market. Investor priorities are shifting towards managers who demonstrate agility and resilience in their strategies, creating a dynamic evolution in these professional partnerships.

| Investor Behavior | Manager Response | Market Outcome |

|---|---|---|

| Seeking agility and resilience | Adopting adaptive strategies | Strengthened investor-manager relationships |

| Prioritizing long-term stability | Focusing on sustainable investments | Increased market confidence |

| Demanding transparency and accountability | Implementing robust reporting systems | Enhanced trust and credibility |

This table succinctly encapsulates the changing dynamics, highlighting the need for managers to align their strategies with investor expectations. As these trends continue, it will be intriguing to observe how they shape the future of commercial real estate investment.

Exploring Investment Opportunities Amidst Rising Risks and Market Volatility

While steering through the tumultuous currents of the commercial real estate market, astute investors are identifying promising opportunities amidst rising risks and market volatility. Investment in sectors like multi-family housing, senior living, and data centers is gaining traction. These sectors are perceived to have robust demand drivers, offering a shield against market volatility. However, the rising risks associated with inflation, interest rates, and climate change should not be overlooked. High insurance costs, for instance, are slowly eating into returns. Consequently, a balanced approach that includes diversification across geographies and sectors can help mitigate these risks. Despite the challenges, the commercial real estate market, with its potential for high yields, continues to hold allure for discerning investors.

Conclusion

The commercial real estate landscape is undeniably shifting, with investors prioritizing stability, transparency, and sustainable investments. Despite potential risks from inflation and climate change, new sectors offer promising opportunities. The key to steering through this evolving market lies in understanding current dynamics, fostering effective investor-manager relationships, and identifying lucrative opportunities amidst market volatility. Ultimately, the future of commercial real estate will be shaped by adaptability and strategic investment decisions.