Soaring Insurance Premiums Create New Challenges for Colorado Buyers and Sellers

Colorado’s housing market has never been simple, but 2026 has introduced a new layer of pressure: surging homeowners’ insurance costs. Property insurance costs are becoming a broader issue, impacting not only homeowners but also renters, as these expenses are often passed through in rental rates. For many buyers, the monthly mortgage payment is no longer the only affordability hurdle. Insurance premiums—once a predictable line item—are now rising fast enough to change budgets, delay purchases, and even reshape where people choose to live. These rising costs are driven by several factors, including climate change, higher property values, and increased construction costs.

For sellers, the ripple effects are just as real. Higher premiums can shrink the buyer pool, complicate appraisals, and extend days on market in certain neighborhoods. In Colorado, average insurance costs have increased significantly over recent years, further impacting property values and rental yields.

Below is a breakdown of what’s driving the shift and what it means for the Colorado real estate market.

Key Takeaways

- Rising insurance premiums are becoming a major affordability barrier in Colorado.

- Climate‑driven risks are pushing insurers to raise rates or reduce coverage options.

- The housing market is feeling the ripple effects on both sides of the transaction.

Why Insurance Costs Are Rising in Colorado

Colorado sits at the intersection of several high‑risk factors that insurers can no longer ignore, putting significant pressure on the homeowners’ insurance market and shaping outcomes at the state level.

These risk factors are driving up insurance costs and homeowners’ premiums across Colorado. As a result, property insurance premiums are rising, affecting both property owners and renters. The value of the property itself, along with overall property values in the region, is increasingly influencing insurance premiums, as insurers factor in the potential cost of rebuilding and market volatility.

1Construction costs: Material inflation has driven up the cost to rebuild homes, especially after disasters. The rising prices of building materials, such as lumber and steel, directly contribute to higher property insurance costs, as insurers must account for higher expenses in the event of property damage or loss.

1. Wildfire Exposure Across the Front Range

Even communities miles from active burn zones are seeing higher premiums due to statewide wildfire modeling, with wildfire risk now recognized as a key driver of rising homeowners’ insurance costs. Insurers are pricing risk based on vegetation density, slope, wind patterns, and historical burn data, not just ZIP codes.

Increased wildfire risk increases the potential for property damage and more frequent hazard events, which in turn drive up homeowners’ insurance costs across the region.

2. Hail Capital of the U.S.

Colorado consistently ranks among the top states for hail damage claims. Roof replacements that once cost $12,000 now often exceed $20,000, and insurers are adjusting premiums accordingly. Having sufficient property coverage is crucial to ensure homeowners are protected against hail-related losses.

3. Fewer Insurance Carriers Willing to Write Policies

Some national carriers have reduced their exposure in Colorado, especially in foothill and mountain‑adjacent communities. When private insurers pull back, some homeowners must turn to state-backed options like the FAIR Plan, which serves as an insurer of last resort and comes with specific insurance requirements and coverage limitations. The FAIR Plan is designed to ensure fair access to insurance for those unable to obtain private coverage, but not all properties or homeowners will be fully insured under these plans. Fewer carriers = less competition = higher premiums.

4. Rising Rebuild Costs

Labor shortages, material inflation, and stricter building codes mean homes cost more to repair or replace. Insurers must raise premiums to keep pace with replacement‑cost requirements. It is crucial for homeowners to maintain adequate coverage to ensure that reconstruction costs are fully covered after a disaster. Without sufficient coverage or if policy limits are too low, homeowners risk facing significant uninsured losses that can lead to major out-of-pocket expenses and hinder recovery.

How This Impacts Colorado Buyers

Higher Monthly Payments

Insurance is now a major variable in the affordability equation. A home that fits the mortgage budget may no longer fit the total monthly payment once insurance is factored in, as buyers must now pay significantly more each month due to rising homeowners insurance costs.

More Underwriting Scrutiny

Buyers are seeing:

- Mandatory roof inspections

- Requirements for Class 4 impact‑resistant shingles

- Wildfire mitigation documentation

- Higher deductibles in hail‑prone areas

Delayed or Failed Closings

If insurance quotes come in too high (or if a carrier declines coverage), buyers may need to renegotiate, switch lenders, or walk away entirely.

Additionally, difficulties in finding policies that adequately cover the property, due to coverage limitations or gaps, can lead to delays or even failed closings.

How This Impacts Colorado Sellers

Longer Days on Market in High‑Risk Areas

Foothill communities, older neighborhoods with aging roofs, and areas with dense vegetation are seeing more buyer hesitation.

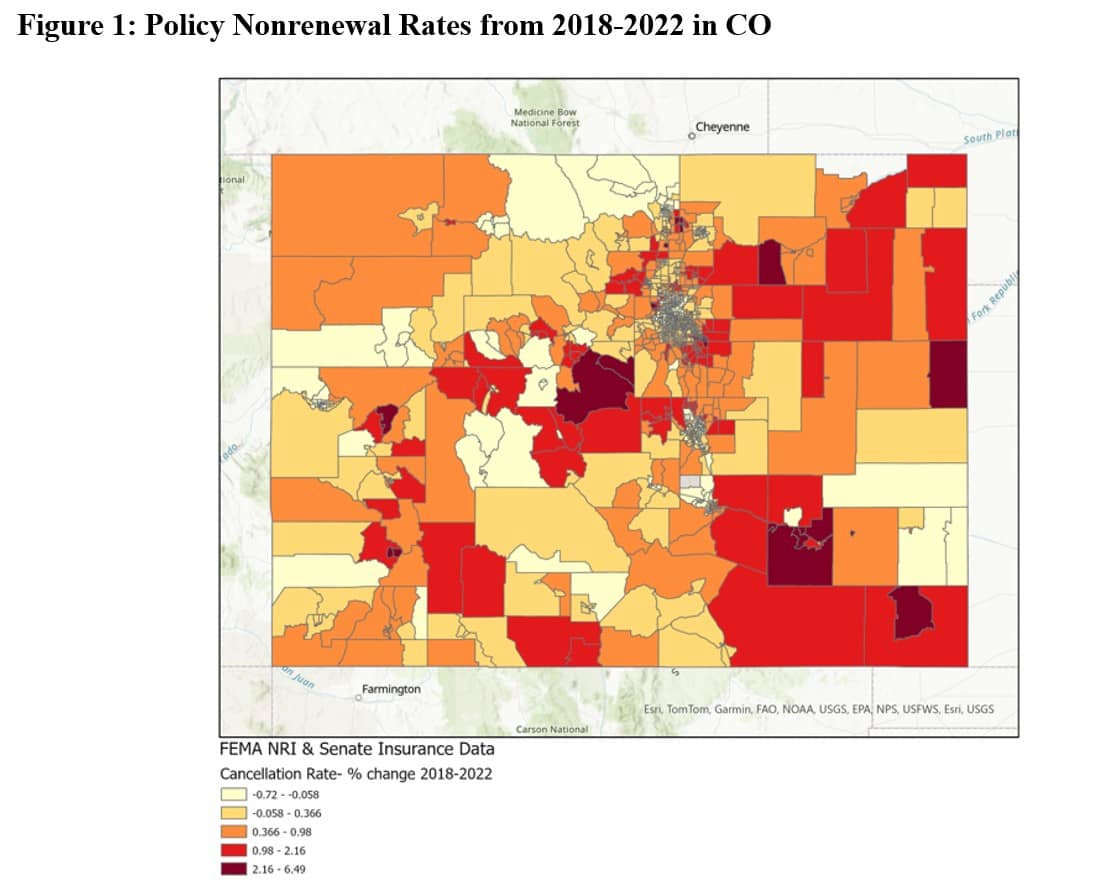

Affected homeowners in high-risk and eastern regions of Colorado are particularly vulnerable, as these areas face increased insurance challenges that can lead to longer days on market.

More Pre‑Listing Preparation

Sellers who invest in:

- Roof upgrades

- Fire‑mitigation landscaping

- Updated electrical systems

- Class A fire‑rated materials often see smoother transactions and stronger offers, as these upgrades help protect both the property and the seller’s interests during the transaction.

Pricing Strategy Matters More Than Ever

Buyers are factoring insurance into their total cost of ownership. Homes priced aggressively may sit on the market longer if insurance premiums push monthly payments too high.

Rising homeowners’ insurance costs can reach a tipping point at which buyers are no longer willing to pay the asking price, forcing sellers to adjust their strategies.

What Colorado Homeowners Can Do

1. Shop Multiple Carriers

With fewer insurers in the state, comparison shopping is essential; homeowners should compare home insurance options and homeowners insurance rates to find the best deal. The average rate can vary significantly between carriers and locations.

2. Improve Mitigation

- Class 4 shingles

- Fire‑resistant siding

- Defensible space

- Updated HVAC and electrical These upgrades can reduce premiums and increase buyer confidence.

3. Request a CLUE Report Early

A home’s claims history can influence premiums. Sellers who know their CLUE report upfront can avoid surprises.

4. Work With a Local Real Estate Team That Understands the Landscape

Insurance is now a strategic part of buying and selling in Colorado. The Storck Team helps clients anticipate costs, navigate carrier requirements, and position their home competitively.

Recently Sold by The Storck Team

Bottom Line

Rising homeowners insurance costs are reshaping Colorado’s housing market in real time. In recent years, the increasing frequency and severity of natural disasters, particularly wildfires, have significantly impacted insurance premiums across the state. Colorado now ranks as the sixth costliest state for homeowners insurance, with its market dynamics drawing comparisons to other high-risk states like California and Florida, where climate change and hazard events drive up costs. Data from the National Bureau, labor statistics, and the Federal Insurance Office all point to a clear upward trend in insurance costs, reflecting both economic and environmental pressures. Additionally, the intense Colorado sun contributes to heightened wildfire risk, further influencing insurance market dynamics and home vulnerability in the state. Whether you’re buying, selling, or simply planning ahead, understanding these pressures is essential. With the right strategy—and the right team—you can stay ahead of the curve.